FinMin introduced reduced tax rate for domestic Companies of 22% with restrictions in certain specific deductions and tax losses. However, there were doubts w.r.t such rate which have been resolved through clarification.

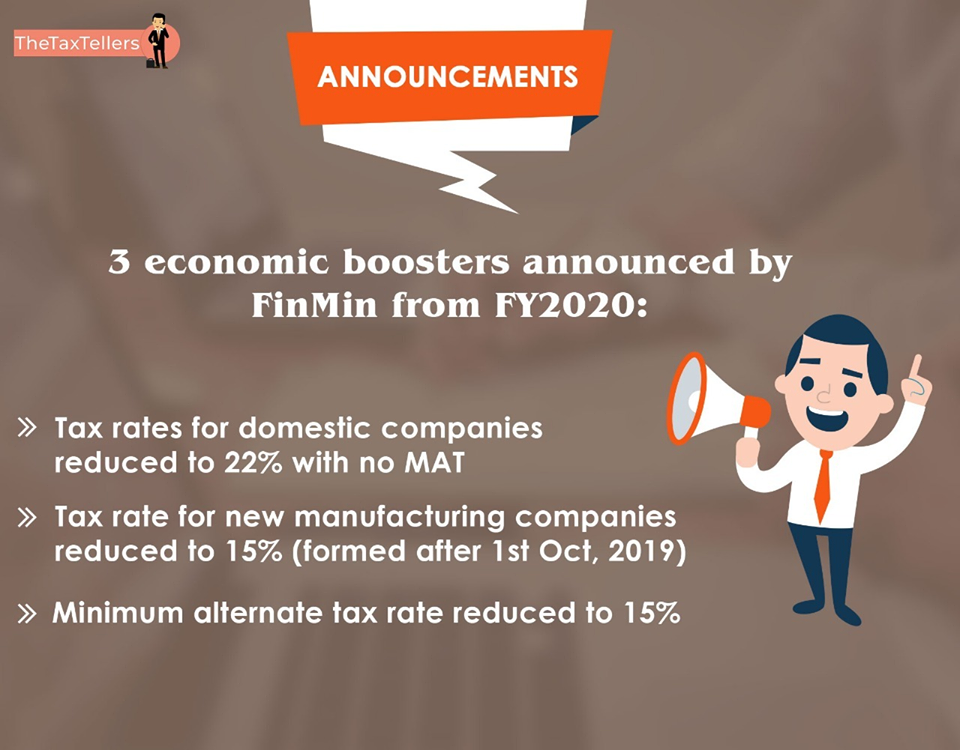

On Sep 20, 2019, pursuant to an Ordinance in Taxation laws, a provision reducing tax rate for domestic Companies to 22% was introduced with restrictions in certain specific deductions and tax losses. Further, it was introduced that provision of MAT would not apply on such Companies exercisin the option. It is an optional provision with a clause to mandatory opt if availed once.

However, there were doubts w.r.t allowance of brought forward losses on account of additional depreciation and MAT credit.

Accoridngly, taking into account the doubts and queries revolving around the issue, CBDT has issued a Circular No.29/2019 dated 2nd October 2019, mentioning following;

1. Availability of brought forward losses: Any company which has opted for such beneficial rate shall not be allowed to set off of loss pertaining to earlier years w.r.t. additional depreciation u/s 32(1)(iia). Accordingly, if an existing company which has brought forward losses wants to avail the benefit, it should opt only after the utilisation of such losses.

2. Availability of MAT Credit: Since, MAT is not applicable on companies opting for such beneficial rate of tax, accordingly, any available MAT credit in the books shall not be allowed for set-off against existing tax profits. Accordingly, if an existing company which has unexpired MAT credit wants to avail the benefit, it should opt only after the utilisaiton of such credit.

In case, you need any clarifications, please feel free to reach out to your Teller or contact us.